Current jobs related to Credit Risk Associate - Canada - Ramp

-

Credit Specialist

2 weeks ago

Canada Innovation Credit Union Full time**Credit Specialist - Adjudication** **Permanent Full Time** **Open to any location in Canada (ability to work remotely/from home office)** **Office space is available in Saskatchewan** **Closes April 1** **Annual Salary: $73,730 - $101,378** **Innovation Federal Credit Union has a bold ambition. In addition to being Canada’s newest Federal Credit...

-

Director, Commercial Credit

3 weeks ago

, BC, Canada Beem Credit Union Full timeAbout Beem: Beem is a new credit union with 80 years of history. Rising to the rapidly evolving challenges of the financial services industry and inspired by cooperative values, our founding credit unions recognized that we can do more together. Beem means light. It means energy. It means a brighter financial future. United as Beem, we are combining our...

-

Director, Commercial Credit

3 weeks ago

, BC, Canada Beem Credit Union Full timeA large credit union in British Columbia is seeking a Director, Commercial Credit to lead its commercial credit function and manage a $3.4B portfolio. The ideal candidate will possess over 10 years of commercial lending experience and demonstrate strong leadership skills. Responsibilities include overseeing credit applications, enhancing portfolio management...

-

Senior Credit Adjudication Specialist

1 week ago

Canada Innovation Federal Credit Union Careers Full timeSenior Credit Adjudication SpecialistJoin Innovation Federal Credit Union as a Senior Credit Adjudication Specialist, reporting to the VP Credit, where you'll mentor staff, lead risk analysis, and play a key role in safeguarding member assets while supporting business growth and continuous improvement. This position offers the opportunity to leverage your...

-

Corporate Credit Risk Analyst

2 weeks ago

Canada Société Générale Full time**Responsibilities**: **ABOUT THE JOB**: Within the Credit Management Group (“CRE”), the Credit Analyst will work under the supervision of a Director - Senior Credit Analyst and will be part of a team responsible for managing a portfolio comprised of large US corporates as well as subsidiaries of non-US groups in diverse industries. The Credit Analyst...

-

Senior Director, Credit Risk and Analytics

2 weeks ago

, , Canada Deel Full timeSenior Director, Credit Risk and Analytics Join to apply for the Senior Director, Credit Risk and Analytics role at Deel About the Company Deel is the all-in-one payroll and HR platform for global teams. Our vision is to unlock global opportunity for every person, team, and business. Built for the way the world works today, Deel combines HRIS, payroll,...

-

Data Scientist, Credit Risk

2 weeks ago

, , Canada KOHO Full timeAbout KOHO We’re on a mission to make financial services better for every Canadian. That means no hidden fees, no predatory interest rates - just financial products designed to help our users spend smart, save more, and build real wealth. We’re a performance organization with a strong heart: we care deeply about outcomes, and everything ties back to our...

-

Director of Credit Risk

2 weeks ago

, , Canada Deel Full timeA leading payroll and HR platform in Canada is seeking a Senior Director, Credit Risk and Analytics. In this role, you will lead the development of credit risk analytics functions and AI-driven underwriting models. You will need at least 15 years of experience in credit risk management and proven leadership skills. The position requires collaboration across...

-

Senior Commercial Credit Risk Manager

2 weeks ago

Nanaimo, British Columbia, VR X, Canada Personal Banking Full time**Posting Deadline: Please submit your application by 11:59 PM PST, January 9, 2026**Position Type: PermanentTogether, Let's Do Great ThingsWe're the largest financial institution based on Vancouver Island and the Gulf Islands, and we've got an opportunity for you. We are looking for a Senior Commercial Credit Risk Manager to support our compliance and...

-

(s): Canada : Alberta : Calgary Scotiabank Global Site Full timeRequisition ID: 244053Join a purpose driven winning team, committed to results, in an inclusive and high-performing culture.Ensure credit adjudication, control activities and related processes are conducted within a strong risk culture, focusing on emerging risks and within risk appetite. Provide an objective oversight and effective challenge, enable...

Credit Risk Associate

3 weeks ago

At Ramp, we're rethinking how modern finance teams function in the age of AI. We believe AI isn't just the next big wave. It's the new foundation for how business gets done. We're investing in that future — and in the people bold enough to build it.

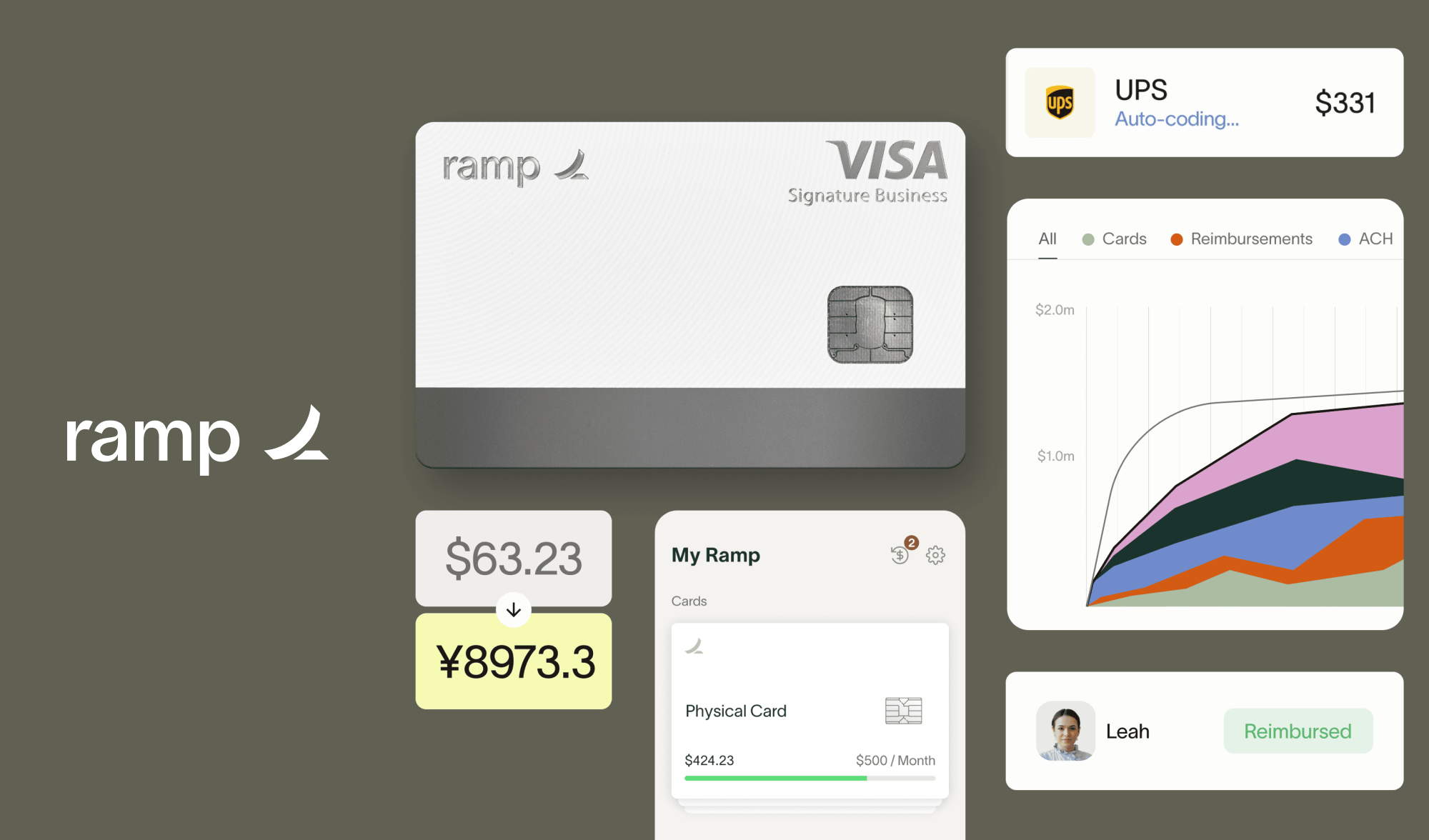

Ramp is a financial operations platform designed to save companies time and money. Our all-in-one solution combines payments, corporate cards, vendor management, procurement, travel booking, and automated bookkeeping with built-in intelligence to maximize the impact of every dollar and hour spent. More than 45,000 businesses, from family-owned farms to e-commerce giants to space startups, have saved $10B and 27.5M hours with Ramp. Founded in 2019, Ramp powers the fastest-growing corporate card and bill payment platform in America, and enables over $100 billion in purchases each year.

Ramp's investors include Thrive Capital, Sands Capital, General Catalyst, Founders Fund, Khosla Ventures, Sequoia Capital, Greylock, and Redpoint, as well as over 100 angel investors who were founders or executives of leading companies. The Ramp team comprises talented leaders from leading financial services and fintech companies—Stripe, Affirm, Goldman Sachs, American Express, Mastercard, Visa, Capital One—as well as technology companies such as Meta, Uber, Netflix, Twitter, Dropbox, and Instacart.

Ramp has been named to Fast Company's Most Innovative Companies list and LinkedIn's Top U.S. Startups for more than 3 years, as well as the Forbes Cloud 100, CNBC Disruptor 50, and TIME Magazine's 100 Most Influential Companies.

About the Role

As a member of Ramp's Risk Strategy & Operations team, you will leverage data to develop and optimize credit strategies, including underwriting and customer management strategies. This role requires an understanding of credit concepts, fluency with data, and the ability to drive a broad set of projects fairly independently. The role also requires the ability to work with cross-functional teams (product, engineering, operations, finance, marketing, sales and design) to partner and execute on risk strategies, and the ability to take ownership of credit risk outcomes and lead strategic initiatives.

What You'll Do

- Leverage internal and external data (e.g. banking data, commercial credit bureau data, financial accounting data, sales data, etc.) to create best in class credit policies (e.g. underwriting, credit limit increase programs, risk management) that will create value for Ramp and its customers

- Understand Ramp's exposure to risk across multiple products (charge card, reimbursements, bill pay, etc.) to create holistic underwriting and risk management strategies

- Investigate and evaluate efficiency of risk policies, procedures, and processes

- Analyze market and industry trends, identify potential macroeconomic risk factors and incorporate in credit policy

- Partner with product, engineering and design teams to execute credit policies, improve operational tooling, and shape the risk management infrastructure

- Partner with data scientists to build and leverage credit risk models in Ramp's credit policy

- Partner with finance teams to create and maintain risk adjusted returns framework, including loss forecasting

What You Need

- Minimum 2 years of experience in credit risk management or quantitative strategy role

- Minimum 2 years of experience using SQL or Python for data retrieval and manipulations

- Experience within consumer/corporate/small business cards, payments, lending, or related industries

- Excellent written and verbal communication skills

Nice-to-Haves

- Experience in high-growth startups

- Experience building complex financial products

- For candidates located in NYC or SF, the pay range for this role is $120,300 - $165,450. For candidates located in all other locations, the pay range for this role is $108,300 - $148,950.

100% medical, dental & vision insurance coverage for you

Partially covered for your dependents

- One Medical annual membership

- 401k (including employer match on contributions made while employed by Ramp)

- Flexible PTO

- Fertility HRA (up to $5,000 per year)

- WFH stipend to support your home office needs

- Wellness stipend

- Parental Leave

- Relocation support to NYC or SF (as needed)

- Pet insurance

If you are being referred for the role, please contact that person to apply on your behalf.

Other noticesPursuant to the San Francisco Fair Chance Ordinance, we will consider for employment qualified applicants with arrest and conviction records.

Ramp Applicant Privacy Notice

Compensation Range: $108.3K - $165.5K