Senior Risk Operations Specialist | Underwriting

3 weeks ago

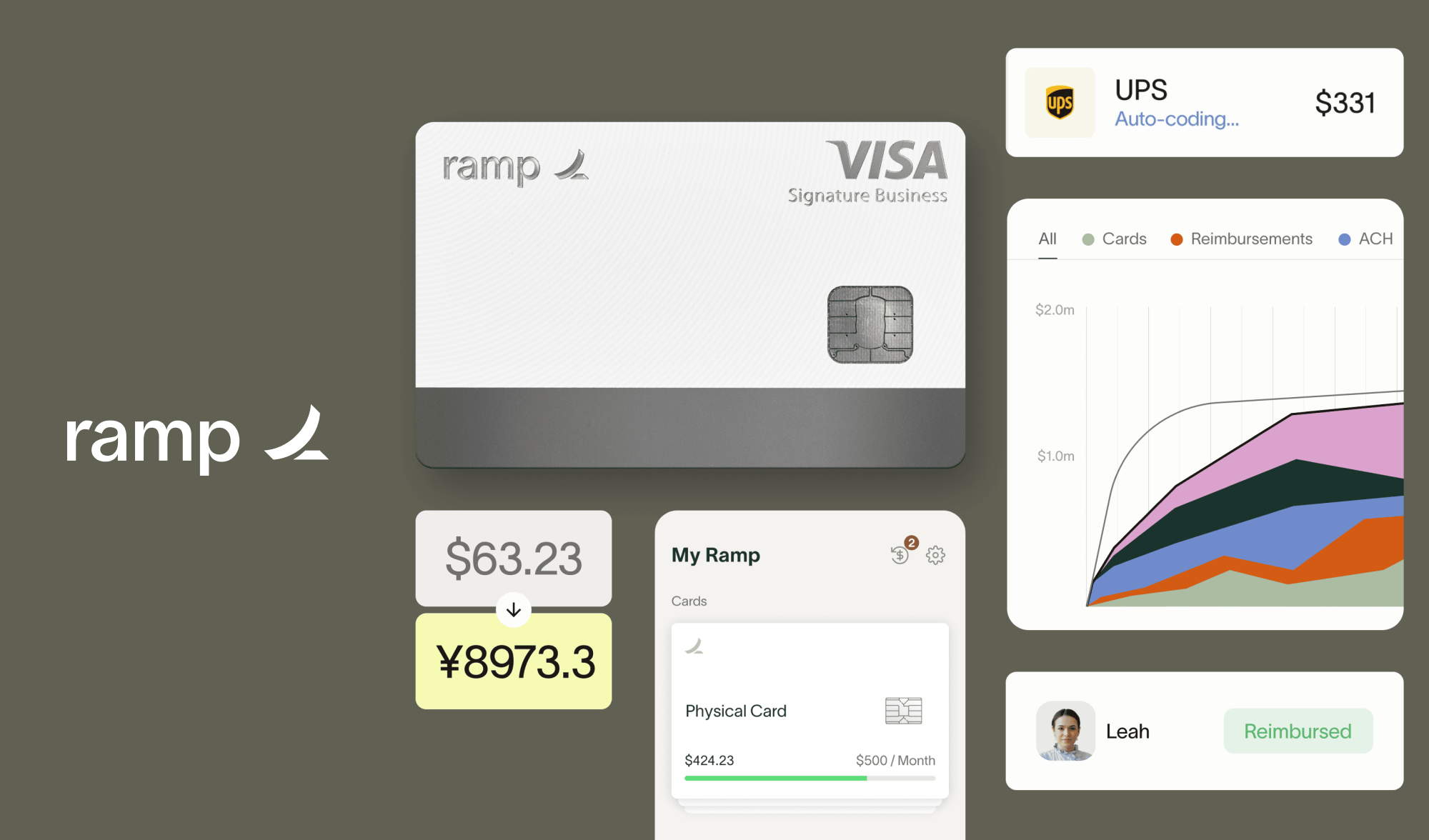

Senior Risk Operations Specialist | Underwriting Join to apply for the Senior Risk Operations Specialist | Underwriting role at Ramp . This range is provided by Ramp. Your actual pay will be based on your skills and experience — talk with your recruiter to learn more. Base pay range $112,200.00/yr - $171,500.00/yr About Ramp At Ramp, we’re rethinking how modern finance teams function in the age of AI. We believe AI isn’t just the next big wave. It’s the new foundation for how business gets done. We’re investing in that future — and in the people bold enough to build it. Ramp is a financial operations platform designed to save companies time and money. Our all-in-one solution combines payments, corporate cards, vendor management, procurement, travel booking, and automated bookkeeping with built-in intelligence to maximize the impact of every dollar and hour spent. We’re building a platform where agents can chase receipts, close books, flag risks, and surface insights, enabling teams to reclaim time and reinvest in what matters. More than 40,000 businesses have saved $10B and 27.5M hours with Ramp. Founded in 2019, Ramp powers the fastest-growing corporate card and bill payment platform in America, and enables over $80 billion in purchases each year. Ramp’s investors include Thrive Capital, Sands Capital, General Catalyst, Founders Fund, Khosla Ventures, Sequoia Capital, Greylock, and Redpoint, among others, plus 100+ angel investors who have been founders or executives of leading companies. Ramp has been named to Fast Company’s Most Innovative Companies list and LinkedIn’s Top U.S. Startups for more than 3 years, as well as the Forbes Cloud 100, CNBC Disruptor 50, and TIME Magazine’s 100 Most Influential Companies. About The Role As a senior member of Ramp's Risk Strategy & Operations, you will drive operational initiatives related to underwriting, customer risk management, and fraud. This role requires an understanding of underwriting processes, fluency with data, and the ability to analyze risk vectors such as credit and fraud. You will take ownership of key initiatives within the team and provide mentorship to peers to elevate decision quality and execution. We take our responsibility to serve our customers’ commitment to their financial health seriously, and our approach is anchored in data-driven and systematic decisions to delight our customers. Weekend work is required for this role, with the flexibility to choose either Saturday or Sunday each week to support underwriting operations. What You’ll Do Develop and execute Ramp’s risk underwriting policy used to onboard new business to the Ramp platform across corporate credit card and bill pay products Build and maintain monitoring dashboards for underwriting outcomes, processes and losses Partner with product and engineering to build best in class risk tooling to increase operations efficiency Research emerging underwriting and fraud trends to innovate on Ramp's decisioning systems and policies Provide best in class customer experience, while managing credit and fraud risk, by effectively managing customer support requests on their application over phone and email Have the ability to grow, develop and learn in a fast-paced, start-up environment Mentor team members within your pod to support decision quality and operational rigor Collaborate cross-functionally to implement risk tooling and help resolve systemic issues impacting underwriting or fraud workflows What You Need Minimum 5+ years of experience in Underwriting, Credit Risk Management or Fraud Risk Management Experience within consumer/corporate/small business cards, payments, invoices, lending, or related industries Excellent written and verbal communication skills Strong background in customer support via email Investigative and critical thinking skills BA/BS from an accredited university Nice-to-Haves Experience in high growth startups Experience building complex financial products Knowledge of SQL or Python Strong background in customer support via phone Compensation For candidates located in NYC or SF, the pay range for this role is $124,700 - $171,500. For candidates located in all other locations, the pay range for this role is $112,200 - $154,350. Benefits (for U.S.-based Full-time Employees) 100% medical, dental & vision insurance coverage for you Partially covered for your dependents One Medical annual membership 401k (including employer match on contributions made while employed by Ramp) Flexible PTO Fertility HRA (up to $5,000 per year) WFH stipend to support your home office needs Wellness stipend Parental Leave Relocation support to NYC or SF (as needed) Pet insurance Referral Instructions: If you are being referred for the role, please contact that person to apply on your behalf. Other Notices: Pursuant to the San Francisco Fair Chance Ordinance, we will consider for employment qualified applicants with arrest and conviction records. Ramp Applicant Privacy Notice Seniority level Mid-Senior level Employment type Full-time Job function Management and Manufacturing We’re continuing to build Ramp and welcome referrals. Referrals increase your chances of interviewing at Ramp by 2x. #J-18808-Ljbffr

-

, , Canada Ramp Full timeEmployer Industry: Financial Operations Technology. Why consider this job opportunity Salary up to $171,500 for candidates located in NYC or SF Comprehensive benefits package, including 100% medical, dental, and vision insurance coverage Flexible PTO and wellness stipends to support work-life balance Opportunity for career advancement and growth within a...

-

Risk Operations Lead | Underwriting

3 weeks ago

, , Canada Ramp Full timeJoin to apply for the Risk Operations Lead | Underwriting role at Ramp 1 day ago Be among the first 25 applicants Join to apply for the Risk Operations Lead | Underwriting role at Ramp Get AI-powered advice on this job and more exclusive features. This range is provided by Ramp. Your actual pay will be based on your skills and experience — talk with your...

-

Risk Operations Lead | Underwriting

2 weeks ago

, , Canada Ramp Full timeAbout Ramp At Ramp, we’re rethinking how modern finance teams function in the age of AI. We believe AI isn’t just the next big wave. It’s the new foundation for how business gets done. We’re investing in that future — and in the people bold enough to build it. Ramp is a financial operations platform designed to save companies time and money. Our...

-

Senior Underwriting Consultant, Risk Management

3 weeks ago

, AB, Canada Manulife Financial Full timeAre you ready to make an impact and steer the future of insurance in a digital world? We're on the hunt for an innovative Senior Underwriting Consultant to join our forward-thinking team. If you're passionate about blending risk management with data insights and cutting-edge digital solutions, we want to hear from you! As a Senior Underwriting Consultant,...

-

Senior Underwriting Consultant, Risk Management

3 weeks ago

, , Canada Manulife Full timeAre you ready to make an impact and steer the future of insurance in a digital world? We're on the hunt for an innovative Senior Underwriting Consultant to join our forward-thinking team. If you're passionate about blending risk management with data insights and cutting-edge digital solutions, we want to hear from you! Position Responsibilities Risk...

-

, , Canada Manulife Financial Full timeSenior Underwriting Consultant Are you ready to make an impact and steer the future of insurance in a digital world? We're on the hunt for an innovative Senior Underwriting Consultant to join our forward-thinking team. If you're passionate about blending risk management with data insights and cutting‑edge digital solutions, we want to hear from you! As a...

-

Senior Construction Underwriting Specialist

5 days ago

th Ave SW, Suite , Calgary, TP T, AB, Canada Ecl Full time $80,000 - $120,000 per yearJob DescriptionSenior Construction Underwriting SpecialistLocation: Hybrid – Calgary, AB preferred (flexible for the right candidate)Industry: Property & Casualty InsuranceEmployment Type: Contract to Start – Potential for Full-Time PermanentOur client, a growth-focused Canadian insurance company specializing in property and casualty products, is looking...

-

Risk Operations Specialist

1 week ago

Canada Ramp Full time $72,700 - $126,600 per yearAbout RampAt Ramp, we're rethinking how modern finance teams function in the age of AI. We believe AI isn't just the next big wave. It's the new foundation for how business gets done. We're investing in that future — and in the people bold enough to build it.Ramp is a financial operations platform designed to save companies time and money. Our all-in-one...

-

Remote Senior Underwriting

6 days ago

, , Canada Manulife Financial Full timeA leading financial services provider in Canada is seeking an innovative Senior Underwriting Consultant to steer their risk management strategy. The role requires 7+ years of underwriting experience and strong analytical skills. Bilingual candidates (French/English) will thrive in this position, focusing on risk management and compliance while streamlining...

-

Senior Life Underwriter

3 days ago

, , Canada Empire Life Full timeThis range is provided by Empire Life. Your actual pay will be based on your skills and experience — talk with your recruiter to learn more. Base pay range CA$65,800.00/yr - CA$123,000.00/yr Location: Any Canadian Location, CA Empire life is looking to hire a Senior Underwriter to join our Retail Operations team! Why pursue this opportunity Empire Life is...