Data Scientist, Credit Risk

2 weeks ago

About KOHO We’re on a mission to make financial services better for every Canadian. That means no hidden fees, no predatory interest rates - just financial products designed to help our users spend smart, save more, and build real wealth. We’re a performance organization with a strong heart: we care deeply about outcomes, and everything ties back to our mission - to financially empower a generation of Canadians. At KOHO, we’re not your average 9-5. We believe real impact comes from people who are trusted, empowered, and supported to do their best work – without sacrificing their lives to do it. We prioritize work-life integration, not just work-life balance. That means asynchronous collaboration, flexible hours, and a remote-first setup built around autonomy and high trust. KOHO is entering its next chapter - leaner, smarter, more AI-integrated. We’re building for impact, not bureaucracy. If you thrive in environments that value clarity, ownership, and bold thinking, you’ll fit right in. About the Role We’re building a world-class financial product and we need someone to help take our data operations to the next level. Our team is growing fast, and we’re looking for a Predictive Modeller to join us. You understand the data-driven decision making needs of a high-growth organization and are focused on concrete outcomes and KPIs. You look for the highest leverage solution to the most important problems, through either pragmatic analysis, a predictive model, or unsupervised learning methods. What you’ll do Design and develop statistical and machine learning models for credit risk parameters (PD, EAD, LGD) across lending products including credit card, line of credit, overdraft, BNPL, etc. Execute full model development lifecycle from data exploration and feature engineering through validation and deployment Implement advanced modelling techniques including regression, classification, ensemble methods, and deep learning algorithms Conduct model performance monitoring, champion‑challenger testing, and regulatory compliance validation Collaborate with Risk Management, Credit, and Product teams to translate business requirements into technical specifications Create automated dashboards, reports, and ad‑hoc analyses to support strategic business decision‑making Document model methodology, results, and insights Lead model refresh initiatives and back‑testing procedures to maintain predictive accuracy and performance Who you are: 5+ years of experience in predictive modelling with demonstrated collaboration across data science, engineering, and product teams Proven experience developing credit risk models (PD, EAD, LGD) for consumer lending products including credit card, line of credit, overdraft, BNPL, etc. Expert proficiency in Python and SQL with hands‑on experience in feature engineering, model development, validation, and performance analysis Strong knowledge of statistical modelling techniques, machine learning algorithms, and model deployment in production environments Experience with MLOps platforms (Sagemaker) Track record of measuring and optimizing business outcomes of machine learning models in live production systems Excellent written and verbal communication skills with ability to present complex technical concepts to non‑technical stakeholders Experience with regulatory frameworks and model risk management practices in financial services Bachelor’s or Master’s degree in Statistics, Mathematics, Economics, Computer Science, or related quantitative field Passion for applying data science to improve financial products and enhance customer financial outcomes What’s in it for you? Opportunity to shape the future of fintech and financially empower a generation of Canadians Competitive compensation & equity

-

Data Scientist, Credit Risk

3 weeks ago

, , Canada KOHO Full timeJoin to apply for the Data Scientist, Credit Risk role at KOHO About KOHO We’re on a mission to make financial services better for every Canadian. That means no hidden fees, no predatory interest rates – just financial products designed to help our users spend smart, save more, and build real wealth. We’re a performance organization with a strong...

-

, , Canada KOHO Full timeA leading fintech company in Canada is seeking a Data Scientist with experience in credit risk modeling to help enhance financial products. The ideal candidate will have over 5 years of predictive modeling experience, expertise in Python and SQL, and a strong background in developing credit risk models. This role promotes a remote-first work culture and...

-

Principal Data Scientist I

2 weeks ago

, , Canada LexisNexis Risk Solutions Full time## .**Principal Data Scientist I****Join us in shaping a more just world.**:LexisNexis, a part of RELX, is a leading global provider of legal, regulatory, and business information. We help customers increase productivity and improve decision-making and outcomes. Our 10,500 experts and innovative tools help us shape a better world for our customers and...

-

Principal Data Scientist I

3 days ago

, ON, Canada LexisNexis Risk Solutions Full timePrincipal Data Scientist I page is loadedPrincipal Data Scientist I Apply locations Ontario time type Full time posted on Posted 30+ Days Ago job requisition id R86714Principal Data Scientist I Are you looking to develop your Data Scientist career? Do you enjoy coaching others to achieve high standards? Join us in shaping a more just world. About Us :...

-

Credit Risk Data Scientist — Remote

2 weeks ago

, , Canada Koho Financial Inc Full timeA leading fintech company in Canada is seeking a Predictive Modeller to enhance their data operations. This role involves designing advanced models for credit risk parameters, requiring strong expertise in Python and SQL. The ideal candidate will have over 5 years of experience and a proven track record in developing credit risk models. The company offers a...

-

Credit Risk Associate

1 week ago

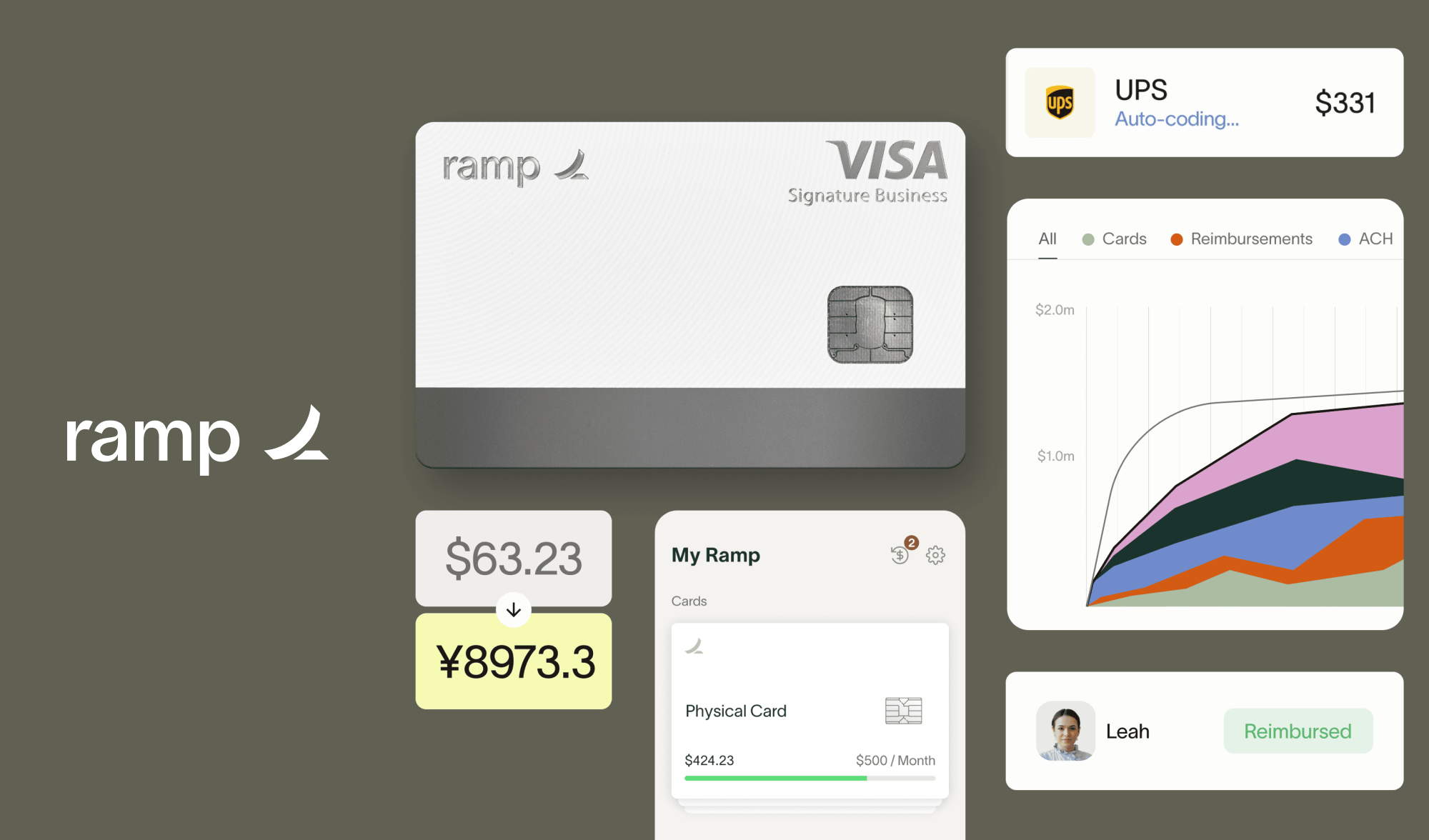

Canada Ramp Full time US$120,300 - US$165,450 per yearAbout RampAt Ramp, we're rethinking how modern finance teams function in the age of AI. We believe AI isn't just the next big wave. It's the new foundation for how business gets done. We're investing in that future — and in the people bold enough to build it.Ramp is a financial operations platform designed to save companies time and money. Our all-in-one...

-

Intermediate Data Scientist

1 week ago

vancouver, Canada (Hybrid) Judi Full time $90,000 - $120,000 per yearIntermediate Data Scientist at JUDI.AILocation: Vancouver, BC (Hybrid – office in Kitsilano)JUDI.AI – who we areAt JUDI.AI, we're on a mission to help transform small business dreams into vibrant communities. As a fast-paced fintech startup, we provide financial institutions with the tools to better understand and serve small businesses. Our values of...

-

Senior Data Scientist II

3 days ago

, ON, Canada LexisNexis Risk Solutions Full time.**Senior Data Scientist II****About our Team:**LexisNexis Legal & Professional, which serves customers in more than 150 countries with 11,800 employees worldwide, is part of , a global provider of information-based analytics and decision tools for professional and business customers. Our company has been a long-time leader in deploying AI and advanced...

-

Data Scientist

3 weeks ago

, AB, Canada Dynamic Risk Assessment Systems, Inc. Full timeOverview Dynamic Risk is a widely recognized integrity, risk management and software solutions company within the energy sector. We’ve been delivering our expertise and solutions since 1996 and we’ve become the industry-leading provider of pipeline integrity management solutions, which includes our suit of IRAS Software Applications. Purpose : The goal...

-

Senior Data Scientist: Cyber Underwriting

4 weeks ago

, , Canada Coalition, Inc. Full timeA leading insurance technology firm is looking for a Senior Data Scientist to optimize underwriting processes and drive data-driven insights using statistical analysis and machine learning. You will work with diverse datasets to improve risk assessment and collaborate with various teams. A Master’s degree and 5+ years of relevant experience required. The...